FedNow: A Game-Changer for Instant Payments in the US

Instant Payments and the Future Forward

Instant payments are all over the news, increasing modern payment operations globally. Many countries have launched instant payment rails, and more are lining up. The world is becoming increasingly digital, and how we transact is no exception. Instant payment systems are becoming necessary in this era, offering several benefits to consumers, businesses, and the economy. These systems provide security, ease, and efficiency while driving innovation. They allow us to send and receive money instantaneously on a 24/7/365 basis and provide real-time visibility into cash flows for better financial and liquidity management.

The most recent launch of instant payments include the FedNow service offered by the Federal Reserve in the US. This blog examines FedNow adoption and its impact in the US.

Real-time payments in the United States

In the evolving landscape of real-time payments (RTP), private players like The Clearing House (TCH), Zelle, Venmo, etc., have been pioneers. TCH’s RTP Network, introduced in 2017, marked a significant step forward in the US payments infrastructure. It enabled financial institutions to facilitate instant payments, leveraging ISO 20022 messaging standards. This network has grown significantly in adoption, integrating with many US demand deposit accounts.

Zelle and Venmo, primarily consumer-focused, have also contributed to the growing popularity of RTP by allowing quick and convenient peer-to-peer transactions. Their model of instant payments has reshaped consumer expectations and set new standards for speed and ease in transactions.

Responding to this shift, the Federal Reserve’s FedNow service, launched in July 2023, marks a significant step toward broader accessibility of RTP in the US. Unlike RTP, which is operated by TCH (owned by a group of large banks), FedNow is operated by the Federal Reserve. This development introduces competition in the RTP space, potentially driving innovation and potential redundancy in the financial system.

In its first nine months of operations, FedNow has grown substantially, with over 688 financial institutions employing the service. This marks a significant increase from its launch in July 2023, which began with 35 participants. This diverse group of institutions ranges in size, demonstrating the wide-reaching appeal and potential of the FedNow.

For comparison, THC's RTP network had around 300 to 400 financial institutions on its platform six years after its launch. FedNow reached over 688 institutions within its first few months of operations, underscoring its successful initial launch.

A recent survey highlighted robust plans among financial institutions to integrate RTP services, with 88 percent indicating plans to implement FedNow and/or RTP within two years. Interestingly, while RTP is more widely implemented (61 percent of financial institutions), FedNow, being relatively new, is on track for implementation by 44 percent of institutions. This reflects a dynamic shift toward embracing real-time payment systems, with a growing preference for third-party providers due to their complex integration and operation.

What is FedNow?

FedNow is a real-time payment service that allows banks to offer their customers instant fund transfers 24/7/365. This eliminates traditional delays associated with payment processing, with longer clearing and settlement windows, and redefines how businesses manage their financial transactions, streamlining fast-paced operations and demanding reconciliation for businesses.

What makes FedNow stand out?

FedNow is instituted and backed by the Federal Reserve. It is an open-access platform, which means any financial institution or developer can build on top of FedNow to create new and innovative products and services. Adopting industry-standard message formats enables interoperability, allowing ease of integration with improved operational efficacy.

Why FedNow is important?

According to the Federal Reserve, the total number of non-cash transactions in the US in 2021 was $257.2 billion, valued at $210.7 trillion.

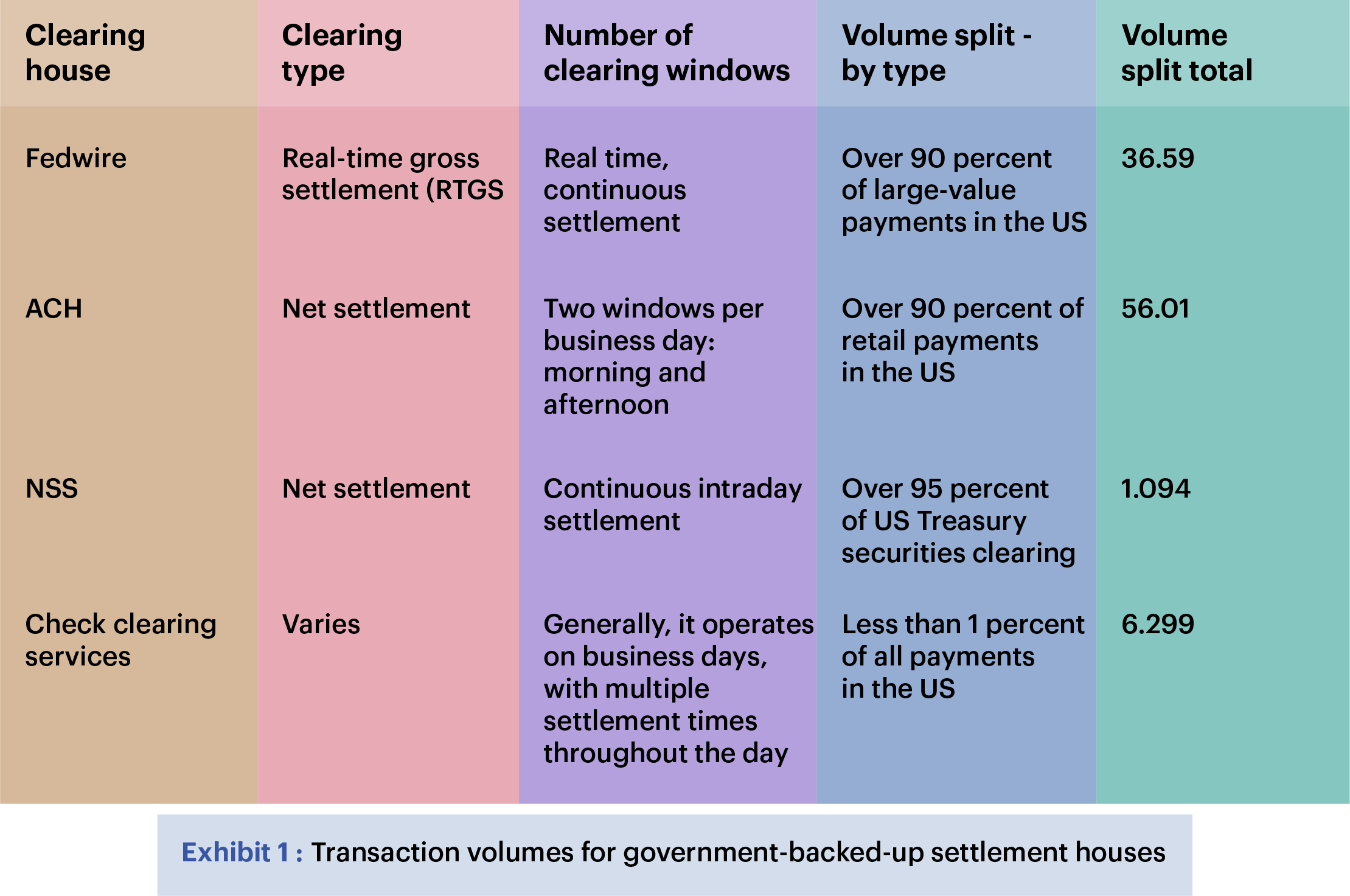

Exhibit 1 underlines the various clearing mechanisms in the US and highlights the gap for real-time, all-day availability throughout the year. As discussed earlier, a federal reserve-backed real-time settlement system is imperative, while private solutions exist.

Fedwire handles over 90 percent of large-value payments, suggesting alternate options are needed. Similarly, the continuous intraday settlement provided by NSS for US Treasury securities indicates the market's growing demand for swift settlement processes.

Here is where FedNow’s superiority lies — in its comprehensive approach. It accommodates retail and large-value transactions by setting higher transaction limits and swift settlement times, positioning itself ideally to meet the market's growing needs.

What FedNow isn’t:

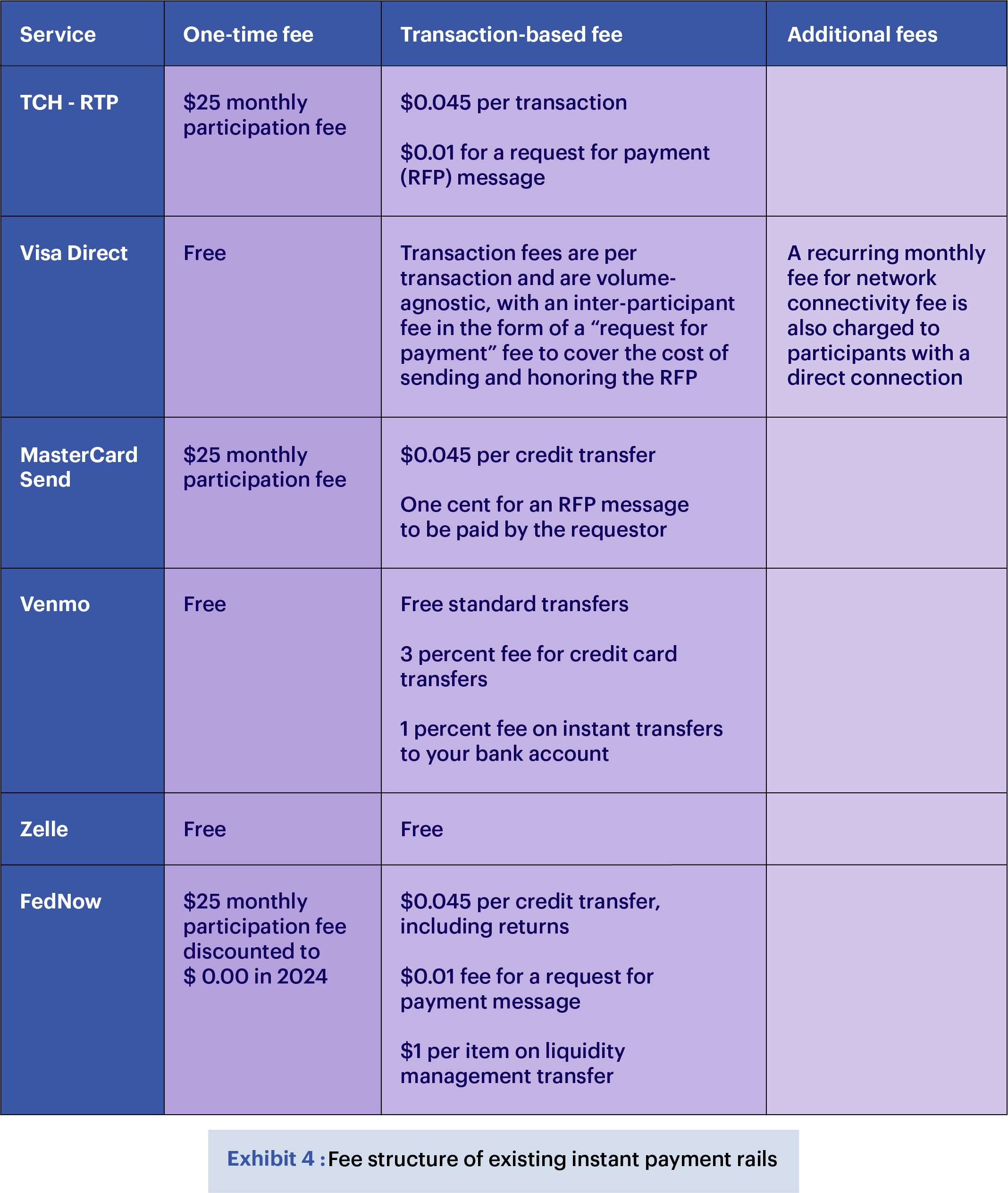

FedNow isn’t a free service. It charges a fee for each transaction. It also doesn't replace the US dollar or other forms of payment, including cash. In fact, FedNow complements other payment methods. It is not a universal payment system and is only available in the US.

FedNow vis-à-vis the competition

The United States is a unique market for instant payments, with a fragmented landscape driven by non-government entities. How is FedNow standing out among them?

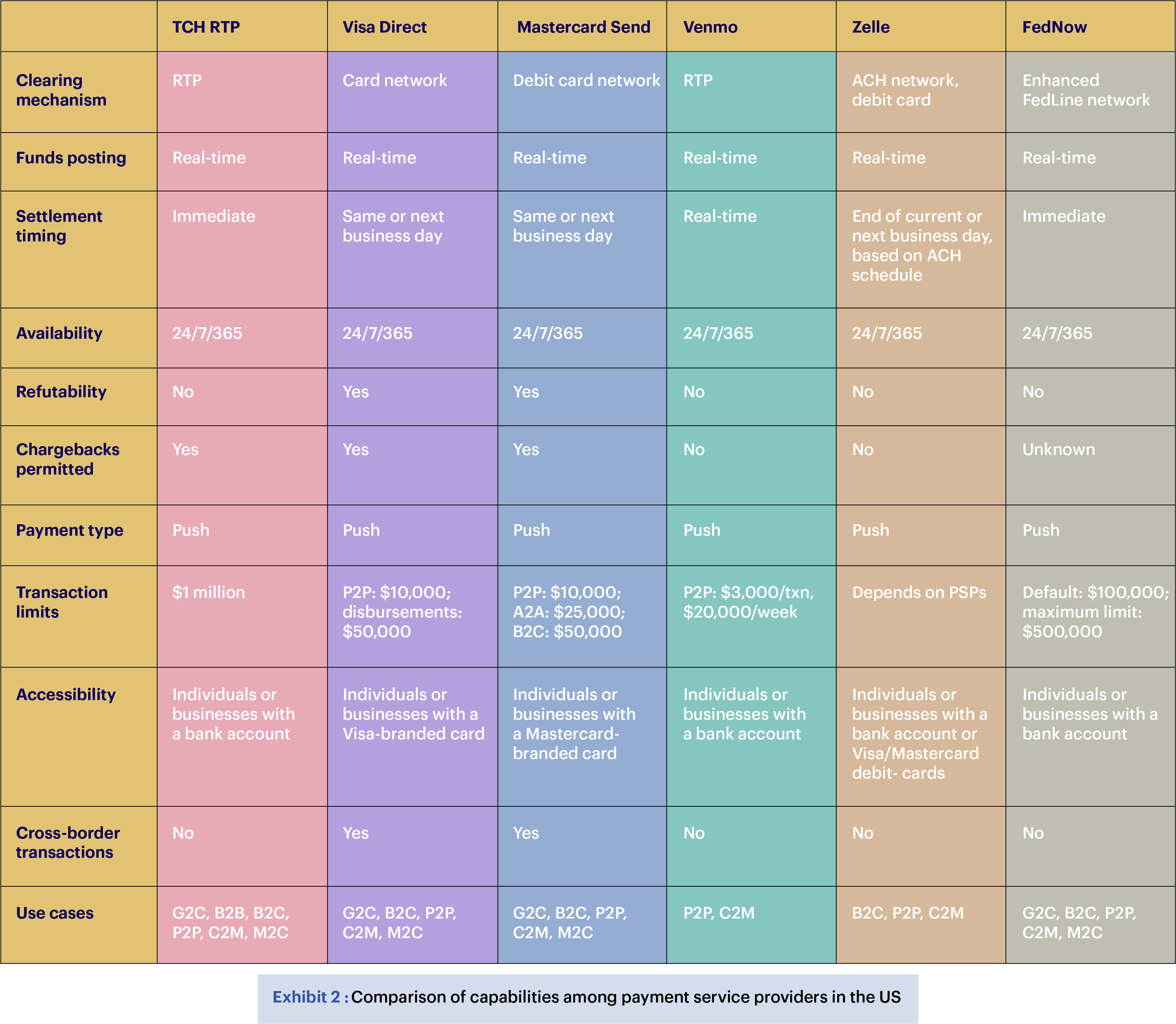

Exhibit 2 is a comparison sheet highlighting the capabilities of the existing payment system and where FedNow stands.

FedNow's use cases

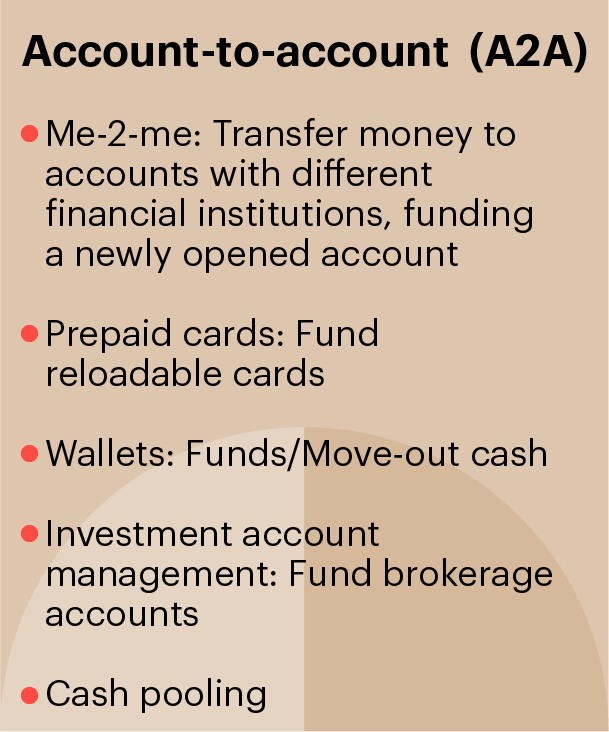

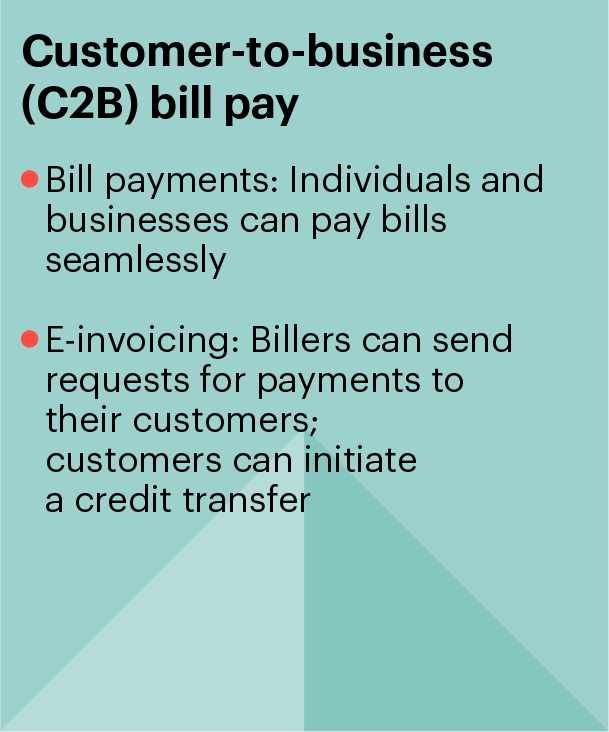

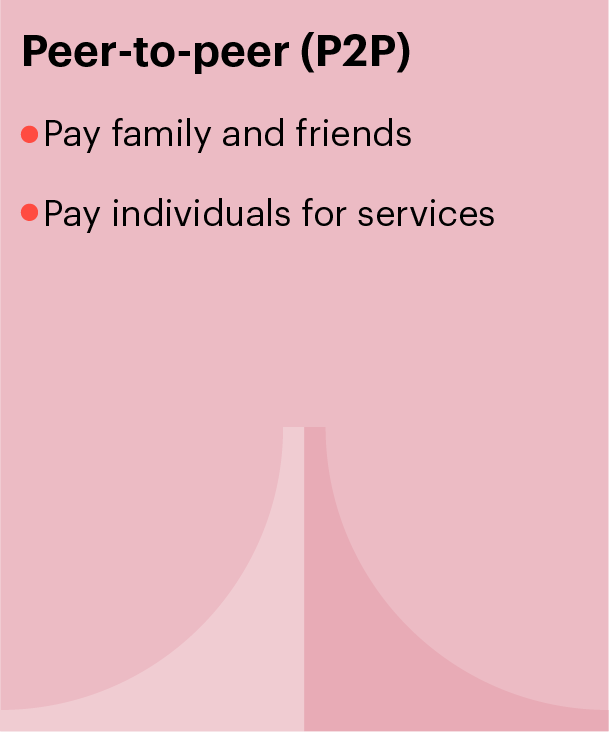

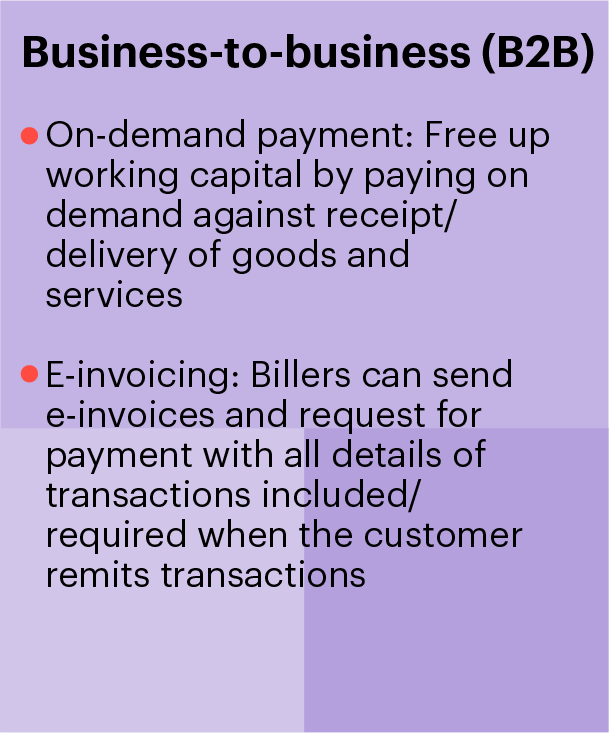

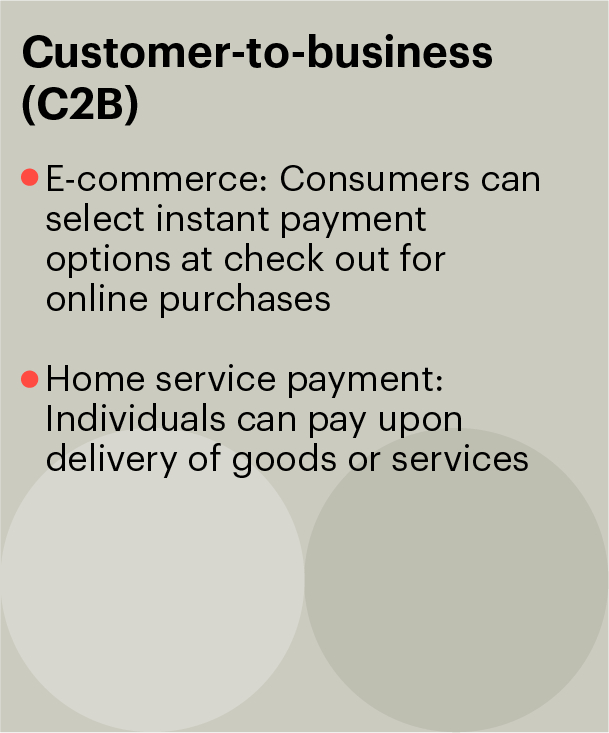

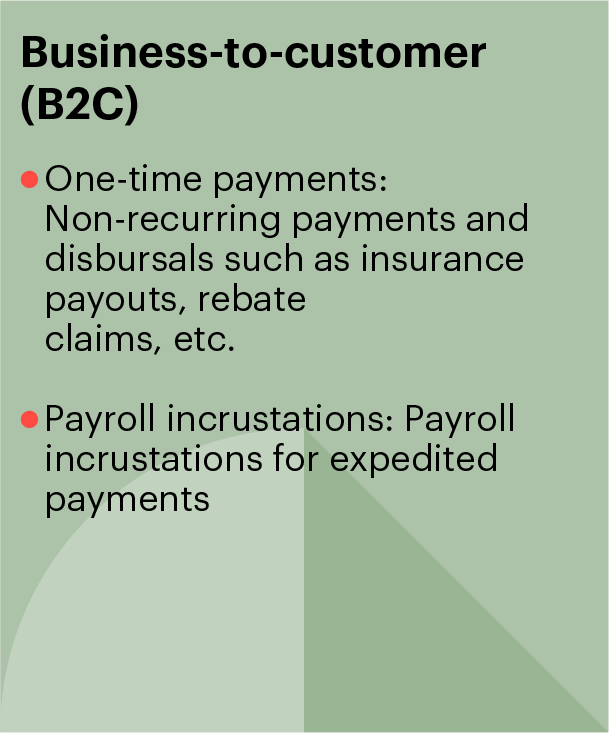

Exhibit 3 represents FedNow’s versatile use cases. From instant bill pay and P2P payments to faster government disbursements and gig economy transactions.

How FedNow differs from other instant payment systemss

FedNow differs from other instant payment systems globally in several ways:

-

Account-based transfer: FedNow does not provide proxy payments but focuses on direct bank account to bank account transfers. This is a key differentiator from other instant payment systems, such as UPI, PayShap, and Zelle, which allow to create a proxy identity to link bank accounts.

-

Higher transaction limit: FedNow's transaction limit is $500,000, significantly higher than the limits of other instant payment systems. This increases the applicability of services for a broad segment of the audience. FedNow's limits are expected to increase as more players adopt it, and it becomes mainstream.

-

Focus on corporate adoption: With its higher transaction limits and identified use cases, FedNow is designed to cater to a wider B2B and B2C audience — unlike other instant payment systems globally with a more retail focus.

The growing adoption of FedNow services enables the application to extend use cases such as:

-

Liquidity management solutions: FedNow offers bank-to-bank transfers and real-time reporting to banks on their payment activities and liquidity levels to ensure efficient liquidity management. Banks can use this information to identify and address liquidity needs early.

-

Improved collections: FedNow can also help improve collections for businesses by enabling faster and more reliable payments. This can reduce costs and improve working capital management.

-

New and innovative payment solutions: FedNow's open and accessible platform can enable the development of new and innovative payment solutions. For example, FedNow can be used to develop new B2B payment solutions that can help streamline the supply chain.

Fee Structure

The Federal Reserve has aligned with the industry's pricing standards by initially setting a fee structure like private sector offerings for its FedNow service. However, to encourage a transition from these providers and to add a unique value proposition, FedNow has now removed its $25 monthly participation fee from 2024 onward. This strategic adjustment mirrors successful practices in global markets, such as India's UPI system, which started free to build a user base before introducing transaction fees. FedNow's zero-cost entry could similarly incentivize a surge in adoption, redefining the economics of instant payments in the US.

Conclusion

FedNow is poised to transform the US payment landscape, leveraging the Federal Reserve's endorsement to ensure safety and extensive reach. Starting in 2024, eliminating the $25 monthly fee will make FedNow more accessible and competitive, encouraging widespread adoption among financial institutions and businesses. This strategic move underscores FedNow's commitment to making real-time payments more affordable and prevalent across various sectors.

As the adoption of FedNow accelerates, it challenges existing payment frameworks and encourages innovation within the financial services industry. This initiative supports the coexistence of diverse payment systems and fosters their convergence toward more efficient and integrated solutions. Looking forward, FedNow's influence in reshaping payment transactions is undeniable, marking a significant step toward a more streamlined, cost-effective financial ecosystem, driving the possibilities of consolidating P2P ecosystems.